Solutions

- Back

For eCommerce Stores

For Enterprise Shipping

For Platforms & Developers

For Crowdfunding Projects

- Back

eCommerce Shipping

High-Volume Brands

Shipping Rate Calculator

International Shipping

Tax & Duty Calculator

Features

- Back

Cheapest Way to Ship

International Shipments

Automation & Productivity

Brand & Revenue Growth

Integrations

Resources

- Back

Free Shipping Tools

Blog & Expert Guides

Customer Success Stories

Contact Us

Solutions

Features

Integrations

Resources

- Pricing

Import Duty Calculator to Iceland

Use this free Import Duty Calculator to estimate your tax and duties when shipping from United States to Iceland based on your shipment value and product type.

Things To Know When Shipping To Iceland

When shipping a package internationally from , your shipment may be subject to a custom duty and import tax. Every country is different, and to ship to , you need to be aware of the following.

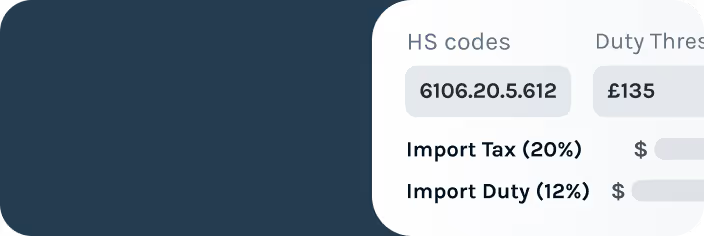

Iceland Import Tax & Custom Fees

Iceland calculates using the CIF method, which means the import duty and taxes are calculated based on the value of the imported goods as well as shipping costs.

Click here or use our calculator to see fees.

There are usually also charges levied by the import customs broker for filing the import customs clearance documents with the local customs authorities. This customs brokerage fee will be in addition to the customs duties and import VAT / GST applied to the imported goods.

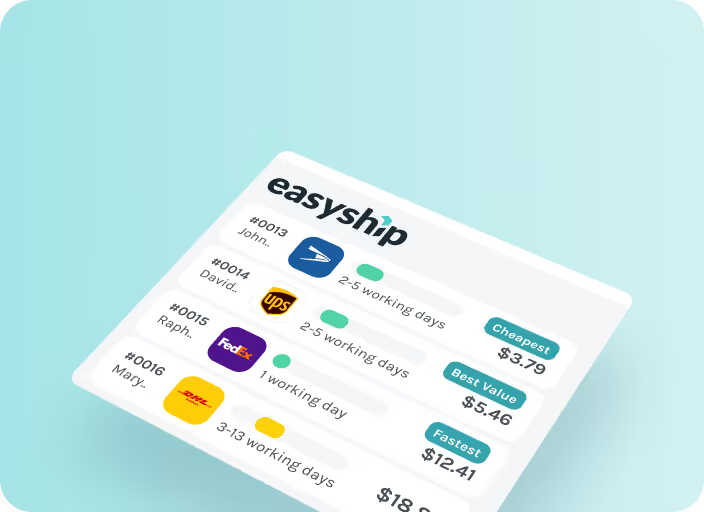

Start Shipping To Iceland With Confidence

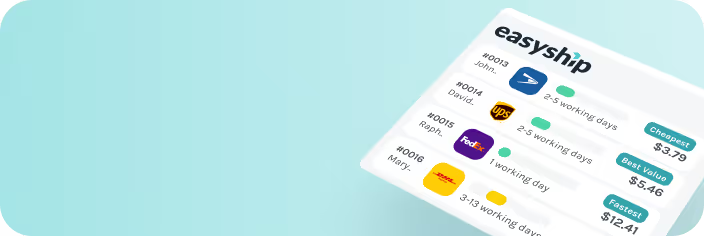

Easyship was built to allow any business to grow by making it easy for them to ship to or any other country in the world.

See how Easyship streamlines customs clearance or sign-up today to ship with these great shipping options.

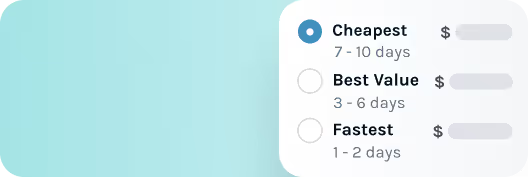

Shipping Rates Based On:

- United States to Iceland

- Dimension of 4x4x4 in

- Weight of 1 lbs

Flat Export

6 - 15 working days

Shipping cost:USD 12.88UPS Worldwide Expedited®

1 - 1 working days

Shipping cost:USD 20.20UPS Worldwide Saver®

1 - 1 working days

Shipping cost:USD 45.78FedEx® International Connect Plus

2 - 5 working days

Shipping cost:USD 20.52

Sign up to see more couriers with more details shipping to Iceland

SIGN UP NOW

Easyship determines the import duties and tax charges for your international orders to Iceland

Custom duties and taxes can be complicated, cause hold ups at customs, incur unexpected shipping costs, ruin the customer experience and have sellers lose their clients. We make sure that you know upfront how much to pay so you can avoid unpleasant surprises and shipment delays in the future.

To calculate import duty rates for your shipment, multiply the taxable value of your shipment by the tax and duty percentage for Iceland.

Remember, import duty percentages vary for each category of goods.

The taxable value is usually based on the value of the goods, but depending on the valuation method of a country, it can also include other amounts.

Import Duty and Taxes FAQ

What is import duty?

Import duty is a tax imposed by a government on goods from other countries. This added tax on imported goods is aimed to make foreign products less desirable and encourage supporting the domestic market.

How can I avoid being charged import taxes in Iceland?

Not paying taxes is tax evasion, which we don't encourage. It's not worth risking your business getting fined. It's best to know any customs duty rate amount that is applicable to your shipment, and be upfront with customers on pricing. Use the import taxes calculator for an estimate or visit our countries information for an individual breakdown.

What happens if I under declare the value of my item?

The customs authority can easily check your business website and other sources to verify if the value listed matches the actual value of the item. Listing a lower value in order to avoid taxes is tax evasion and against the law.

Calculate Import Duty for Any Country:

Albania | Algeria | Australia | Austria | Belgium | Bosnia and Herzegovina | Bulgaria | Canada | Comoros | Congo | Croatia | Cyprus | Czech Republic | Denmark | Estonia | Finland | France | Germany | Greece | Hong Kong | Hungary | Iceland | India | Indonesia | Ireland | Israel | Italy | Japan | Latvia | Lithuania | Luxembourg | Malaysia | Malta | Mexico | Netherlands | New Zealand | Norway | Philippines | Poland | Portugal | Serbia | Singapore | Slovakia | Slovenia | South Korea | Spain | Sweden | Switzerland | Taiwan | Thailand | Turkey | United Arab Emirates | United Kingdom | United States | Vietnam

Get the latest shipping news, expert guides and invites.

By signing up, you agree to receive marketing emails from Easyship. Unsubscribe at any time.