Solutions

- Back

For eCommerce Stores

For Enterprise Shipping

For Platforms & Developers

For Crowdfunding Projects

- Back

eCommerce Shipping

High-Volume Brands

Shipping Rate Calculator

International Shipping

Tax & Duty Calculator

Features

- Back

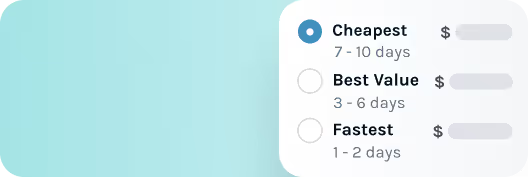

Cheapest Way to Ship

International Shipments

Automation & Productivity

Brand & Revenue Growth

Integrations

Resources

- Back

Free Shipping Tools

Blog & Expert Guides

Customer Success Stories

Contact Us

Solutions

Features

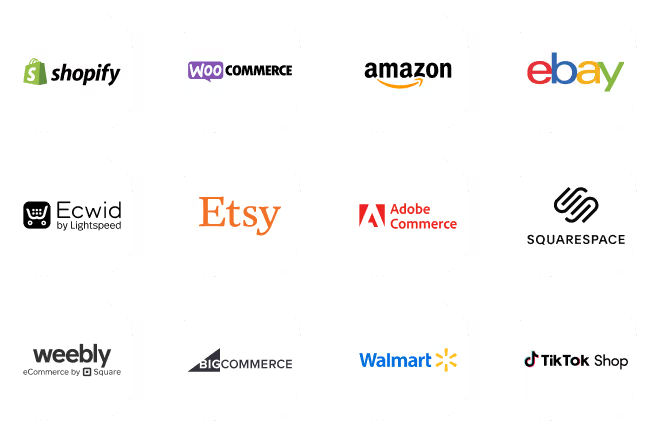

Integrations

Resources

- Pricing

Calculadora de aranceles e impuestos para Argentina

Estime sus impuestos y aranceles al enviar desde España a Argentina en función del peso de su envío, el valor y el tipo de producto.

Cosas que hay que saber al realizar envíos a Argentina

Al hacer un envío internacional desde , este puede estar sujeto a un arancel aduanero y a un impuesto de importación. Cada país es diferente, y al enviar a , debe tener en cuenta lo siguiente.

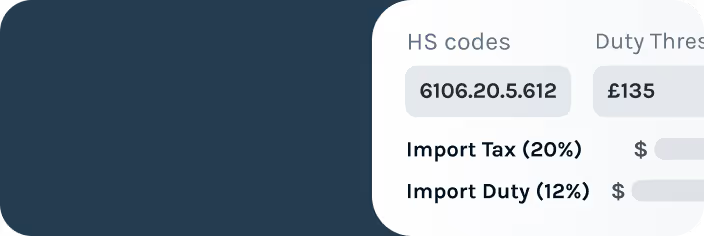

Impuestos de importación y aranceles aduaneros en Argentina

En Argentina, el cálculo se realiza utilizando el método CIF, lo que significa que los aranceles e impuestos de importación se calculan en función del valor de las mercancías importadas, así como de los gastos de envío.

Haga clic aquí o utilice nuestra calculadora para ver las tarifas.

country.duties-taxes.intro-expanded-text

Comience sus envíos a Argentina de forma segura

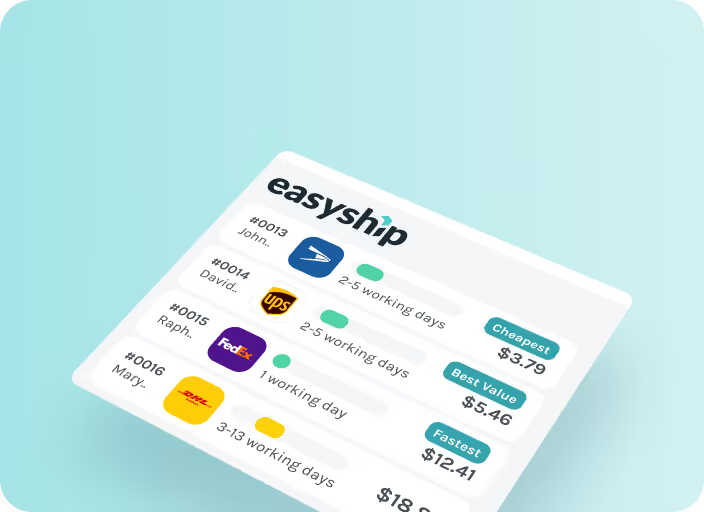

Easyship se creó para permitir que cualquier negocio crezca, facilitando sus envíos a o a cualquier otro país del mundo.

Vea cómo Easyship agiliza el despacho de aduanas o regístrese hoy mismo para enviar con estas magníficas opciones de envío.

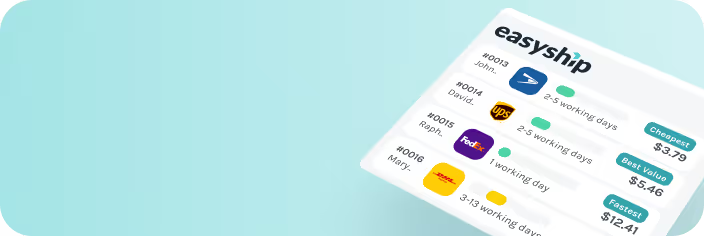

Tarifas de envío basadas en:

- Desde España a Argentina

- Dimensiones: 10 × 10 × 10 cm

- Peso de 0.5 kg

- días laborables

Gastos de envío: 0,00

Regístrese para ver más empresas de mensajería y más información sobre los envíos a Argentina

REGÍSTRESE AHORA

duties-calc.how-we-calc.title

duties-calc.how-we-calc.text

duties-calc.faq.title

duties-calc.faqs.faq-1-question

duties-calc.faqs.faq-1-answer-1

duties-calc.faqs.faq-2-question

duties-calc.faqs.faq-2-answer-1

duties-calc.faqs.faq-3-question

duties-calc.faqs.faq-3-answer-1

duties-calc.countries.title

Albania | Alemania | Argelia | Australia | Austria | Bélgica | Bosnia y Herzegovina | Bulgaria | Canadá | Chipre | Comoras | Congo | Corea del Sur | Croacia | Dinamarca | Emiratos Árabes Unidos | Eslovaquia | Eslovenia | España | Estados Unidos | Estonia | Filipinas | Finlandia | Francia | Grecia | Hong Kong | Hungría | India | Indonesia | Irlanda | Islandia | Israel | Italia | Japón | Letonia | Lituania | Luxemburgo | Malasia | Malta | México | Noruega | Nueva Zelanda | Países Bajos | Polonia | Portugal | Reino Unido | República Checa | Serbia | Singapur | Suecia | Suiza | Tailandia | Taiwán | Turquía | Vietnam

Get the latest shipping news, expert guides and invites.

By signing up, you agree to receive marketing emails from Easyship. Unsubscribe at any time.